Anyone checked their portfolio lately, or heard about the volatility on the sharemarket on the news?

It’s likely down, maybe as high as 10% over the last month. Some seasoned investors will understand this is par for the course, while others may be feeling a bit more anxious.

Volatility is a test to all investors. It reminds me of a story I heard last week about professional athletes competing at the Olympics, or in this case, Rowing World Championships. It’s not about getting the perfect stroke every time. It’s how they react under pressure that decides everything. I saw footage of a rower making a basic mistake under pressure on the world stage and it cost the team the victory.

The difference here is we’re not under scrutiny from others, it’s worse; we’re under scrutiny from ourselves.

Here’s the thing – volatility is normal and completely expected. For long-term investors, reacting emotionally to volatile markets may be more detrimental to portfolio performance than the draw-down itself.

We’ve prepared our clients, educated and empowered them, so that in times like this they are saying ‘So what’. They can say ‘so what’ because it was expected. We know there will be returns that range year to year, it’s the long term expected return that we want. In order to get that long term expected return, you need to be in the market. You need to be in your seat.

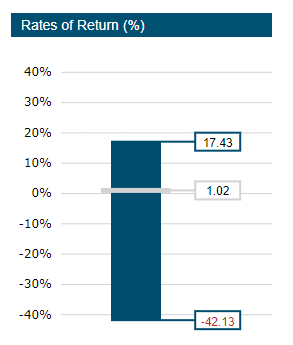

Below you can see a simple graph highlighting the range of expected monthly returns for Australian shares for available data going back to 1980 (38 years).

The highest monthly return was 17.43% and lowest was a whopping -42.13%. The S&P/ASX 200 index is down 5.9% since 1 October. Last month, it was -1.28%. Next month, who knows? If it’s in the range of 17% to -42% what is going to go through my head (and I hope our clients do the same) will be “So what”.

A footy team with their eye on the premiership doesn’t expect to win every game. They have losses and stick to the plan, and overall they win. A professional ballerina doesn’t get every step perfect, she has to hold herself and be composed in moments under pressure. A professional rower doesn’t get every stroke perfect. It’s how they react under pressure that decides everything.

During times like this, it can feel like your investments are failing. They aren’t. Trust in your plan, it’s been designed with a long term focus. Provided you are able to remain calm during periods of short-term uncertainty, you will reap the long term benefits.